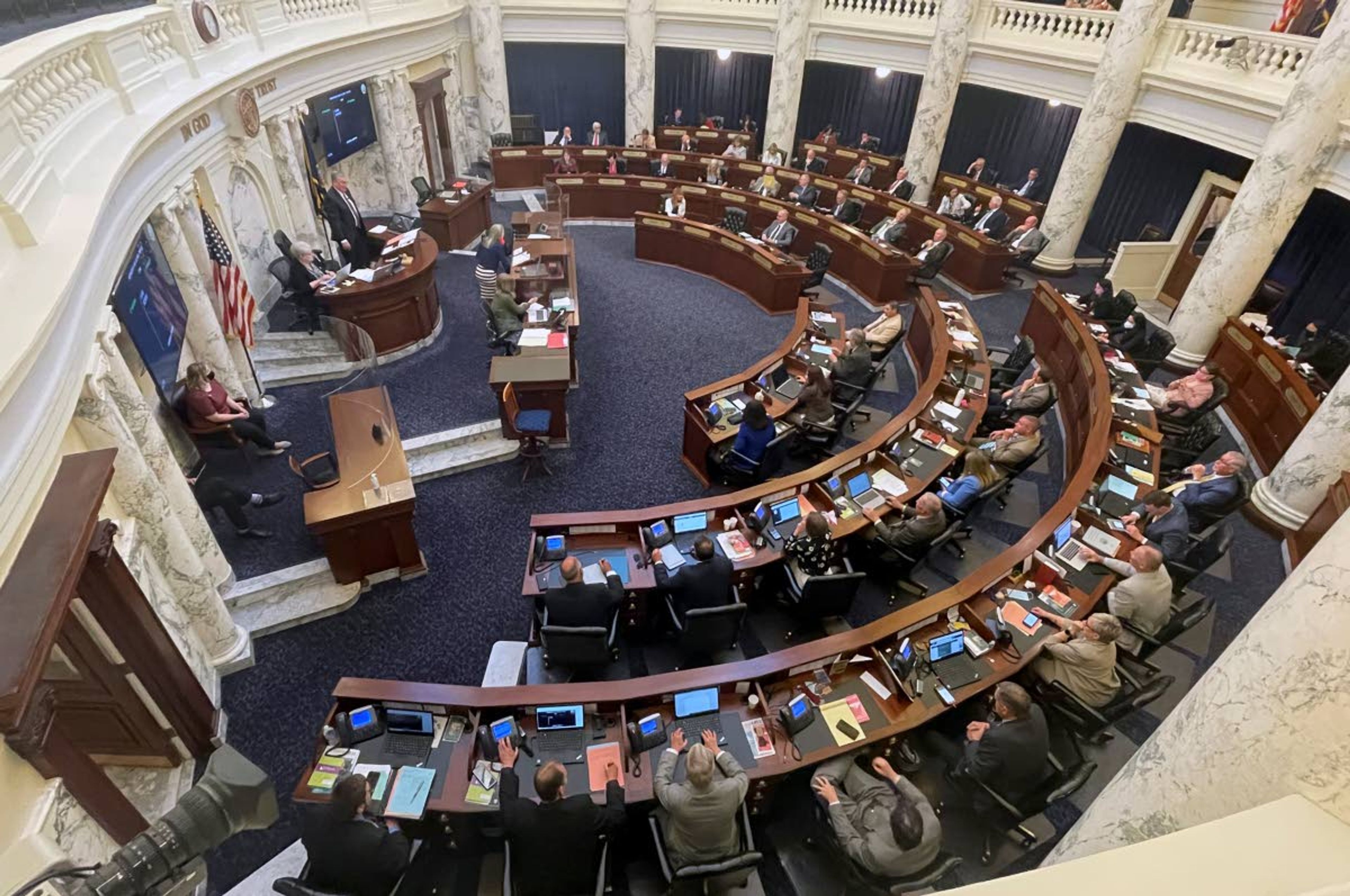

Lawmakers look to address property tax

There is little consensus among the Idaho Legislature on how to approach the issue

BOISE — Property tax relief remains a hot topic at the Idaho Legislature, but there’s little consensus on how — or even if — to address the issue.

Gov. Brad Little outlined a $600 million tax cut proposal in his State of the State address Monday. However, it focuses exclusively on income tax rates and, if approved, likely soaks up all the revenue available this year for any kind of tax relief.

Nevertheless, Alex Adams, the governor’s budget director, said Little’s 2022 and 2023 budget recommendations include several items that could help reduce the local tax burden.

“There are zero dollars in the (state) budget that come from property taxes, so it’s difficult for us to provide direct relief,” Adams said. “But we did spend a lot of time talking about what’s driving the increase in property taxes and what the state can do to help mitigate the problem.”

For example, voter-approved supplemental school levies generate more than $200 million in local property taxes each year. The levies help pay for things like increased teacher salaries, all-day kindergarten and employee health insurance.

Adams noted that Little proposed an 11% increase in public school support in 2023 — the largest increase in more than 20 years. That includes a 10% raise for teachers, an extra $4,000 per employee for health insurance and another $47 million in literacy funds, which could be used for all-day kindergarten.

“That should help mitigate the need for local property tax increases,” he said.

Road maintenance is another major expense for local property taxes, so the governor is recommending $200 million in one-time funding for local bridge improvements, plus $80 million in ongoing general fund support for local road maintenance.

Another $450 million in state and federal funding would be set aside for local drinking water and wastewater projects, Adams said, eliminating the need to bond for them.

Finally, local governments should benefit from updated guidance that was recently released regarding federal American Rescue Plan funds.

The initial guidance last year indicated the money could only be used for water, sewer and broadband projects. However, Adams said the final guidelines released Jan. 6 allow cities and counties to use as much as $10 million for pretty much any purpose, including property tax relief.

“That should give mental comfort to darn near every city and county in Idaho,” Adams said. “They (the federal government) believes most units of government lost at least $10 million in revenue as a result of the pandemic, so the first $10 million can be used for any purpose.”

Most local governments in Idaho received less than $10 million in total stimulus funds.

Nevertheless, between the federal monies they did get and the governor’s budget recommendations, Senate Local Government and Taxation Chairman Jim Rice, R-Caldwell, thinks fiscally responsible cities and counties have an opportunity to provide property tax relief for their citizens.

The question is, will they?

“There’s no requirement that any of the funds be used for property tax relief,” Rice said. Consequently, “it will be up to citizens to work with local officials to make sure that additional funding actually reaches them.”

House Majority Leader Mike Moyle, R-Star, sounded a similar note Monday, when asked if any of the projected $1.9 billion budget surplus this year might be used to reduce local property taxes.

“It’s not a state issue,” he said. Property tax decisions “are all made by local elected officials. If your property taxes are going up, it means you elected someone who raised your taxes.”

Moyle noted the state already sends about $700 million back to local governments each year through various revenue-sharing programs.

“But there comes a point where the state can’t take care of education and all the other things it needs to do if it’s subsidizing local governments,” he said.

Rice agreed that proposals to devote more general fund dollars to property tax relief face “an uphill battle” this session. However, he said other options are in the works.

For example, he’s working with county assessors on switching to a five-year rolling average for assessed values, which should help flatten sharp spikes in home valuations.

Similarly, he’s looking for ways to give local voters more say in how they are taxed. One possibility would be to let them approve an increase in local sales tax rates on the condition that it be matched by an equivalent reduction in property taxes.

“It basically asks if they’d rather pay a little more in sales tax and a little less in property taxes,” he said.

Property taxes are a difficult and complex issue, Rice said. It took more than 100 years to eliminate property taxes as a revenue source for the state. Now the focus has shifted to local government.

“We’ve done all the easy stuff, so now we’re left with more challenging problems,” he said. “I don’t expect everything to be solved this session, but I expect to make significant progress. And it’s important that we make progress.”

Spence may be contacted at bspence@lmtribune.com or (208) 791-9168.