Easy peasy: Tax cut bill passes committee

Measure in Idaho Legislature would institute a one-time rebate, ongoing income tax rate cuts

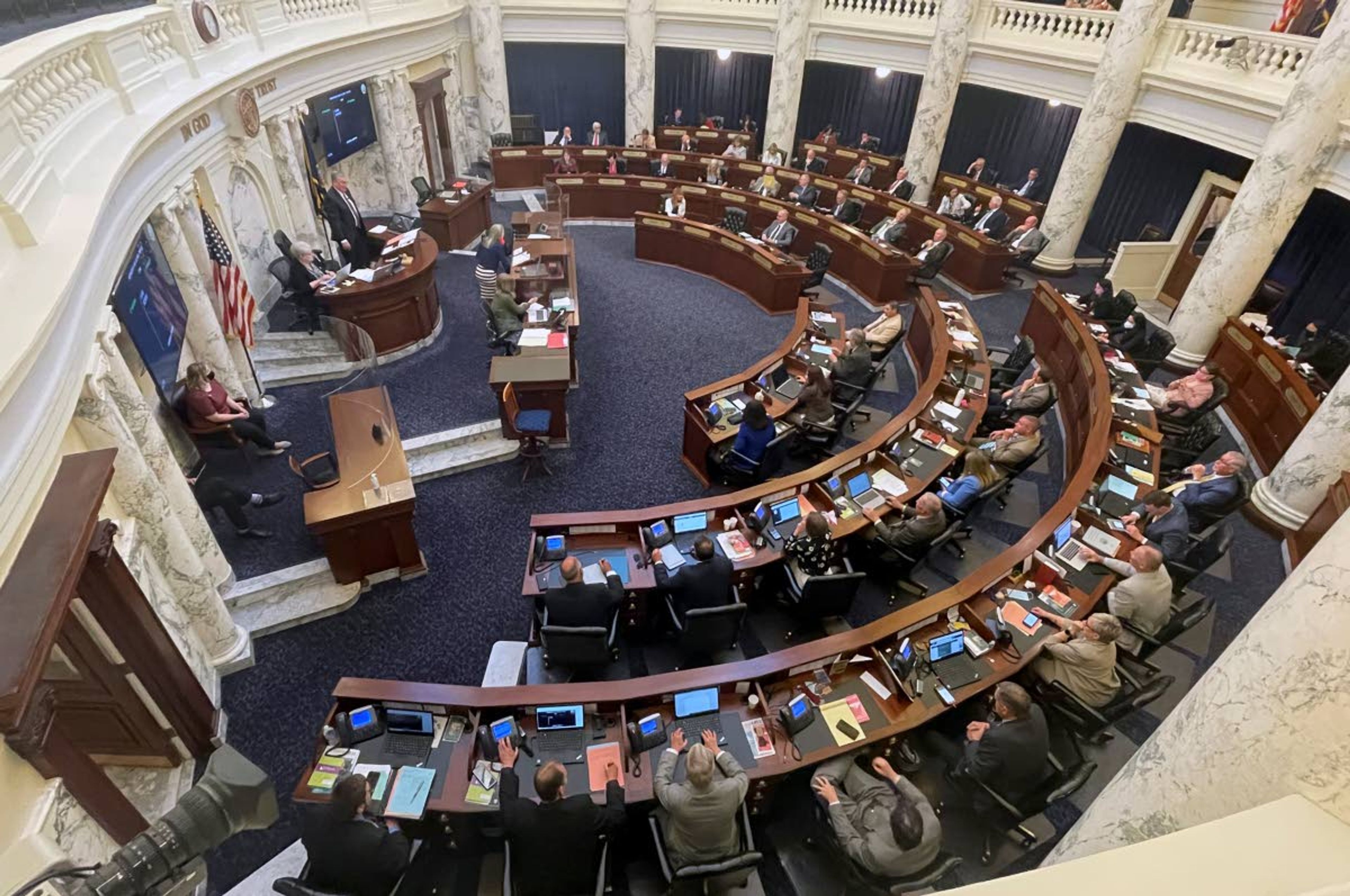

BOISE — The largest tax cut in Idaho history earned an easy thumbs-up Tuesday from the House Revenue and Taxation Committee, on a straight party line vote.

House Bill 436, the first bill introduced this session, includes a one-time tax rebate worth $350 million and an ongoing $251 million reduction in income tax rates.

The measure drops the top corporate and individual income tax rates from 6.5% to 6%, and lowers the number of individual income tax brackets from five to four. The tax rebate would equal 12% of someone’s 2020 income tax payment or $75, whichever is greater.

House Majority Leader Mike Moyle, R-Star, said the legislation will help attract new businesses to Idaho, and assist those that are already here.

“We need to make Idaho competitive with our surrounding states. This bill accomplishes that,” he said. “We need to help Idahoans. This bill accomplishes that. We need to do what’s right, and this bill accomplishes that.”

In an unusual move, two people from Gov. Brad Little’s office testified in favor of the bill.

Policy Director Sam Eaton thanked Moyle and committee Chairman Steven Harris, R-Meridian, for working with the governor over the fall to develop the legislation.

“The governor’s adage is that taxes should be fair, simple, competitive and predictable, and he believes HB 436 is a strong step in that direction,” Eaton said.

Alex Adams, the governor’s budget director, said Idaho’s “red-hot” economy, combined with fiscally conservative budgeting, mean Little can propose this record tax cut while simultaneously recommending record investments in education and transportation.

“One thing this governor has done that’s different from his predecessors is he forecasts revenues and spending over a five-year period,” Adams said. “He does that so we can stress test whether the budget remains balanced under different economic inputs. I can say this tax cut fits within that budget over the next five years and maintains healthy ending balances.”

Ann Ford, of Boise — one of several individuals who testified in opposition to the bill — questioned whether the state can really claim to have a budget surplus at a time when Idaho children are going hungry, when property taxes are soaring and when roads are crumbling.

“Most importantly, can a surplus be called that when Idaho continues to impose a sales tax on groceries, which most states don’t do?” she asked. “The tax on food takes more of your income the less you make, and that’s not fair … A lot of Idahoans like me would rather see equitable tax relief in the form of a grocery tax exemption, and fear we’ll never see that if this bill goes through right off the bat.”

Kathy Dawes, of Moscow, also testified in opposition to the bill, saying it benefits the wealthiest Idahoans at the expense of education and lower-income residents.

“The budget ‘surplus’ is largely the result of persistently under-funding education,” she said. “Idaho students deserve better than this. Instead of tax cuts, please use our taxes to (quoting from the Idaho Constitution) ‘establish and maintain a general, uniform and thorough system of public, free common schools.’”

Several business and advocacy groups, by contrast, testified in support of the legislation, including the Idaho Freedom Foundation, National Federation of Independent Businesses and Idaho Association of Commerce and Industry.

Caroline Merritt, representing the Idaho Chamber Alliance, said reducing corporate income tax rates strengthens one of the few tools in Idaho’s economic development tool kit.

“There are a lot of other states with more powerful tools than what we have in Idaho,” she said. “Some offer very large cash incentives, for example. So, demonstrating a sustained commitment to lowering corporate tax rates is very helpful in attracting the attention of businesses that are considering Idaho for an expansion or relocation.”

This latest tax cut comes on the heels of the $383 million tax cut that was approved last year. That legislation included a one-time rebate worth $220 million and an ongoing $163 million reduction in income taxes.

There was almost no discussion or committee debate on the proposal.

The committee voted to send the legislation to the House floor with a favorable recommendation. The two Democrats on the committee, Reps. Lauren Necochea, D-Boise, and James Ruchti, D-Pocatello, were the only votes in opposition.

“Over the last few years, we’ve seen income inequality only grow with the pandemic,” Necochea said. “To have a rebate where the middle 20% of households are going to get $168 on average and the top 1% is going to get $8,000 checks is tone-deaf, and I think it exacerbates the inequality we have.”

Spence may be contacted at bspence@lmtribune.com or (208) 791-9168.