House committee hears property tax bills

Rep. Josh Tanner proposes two options removing exemptions from some nonprofits to try and reduce levy rates

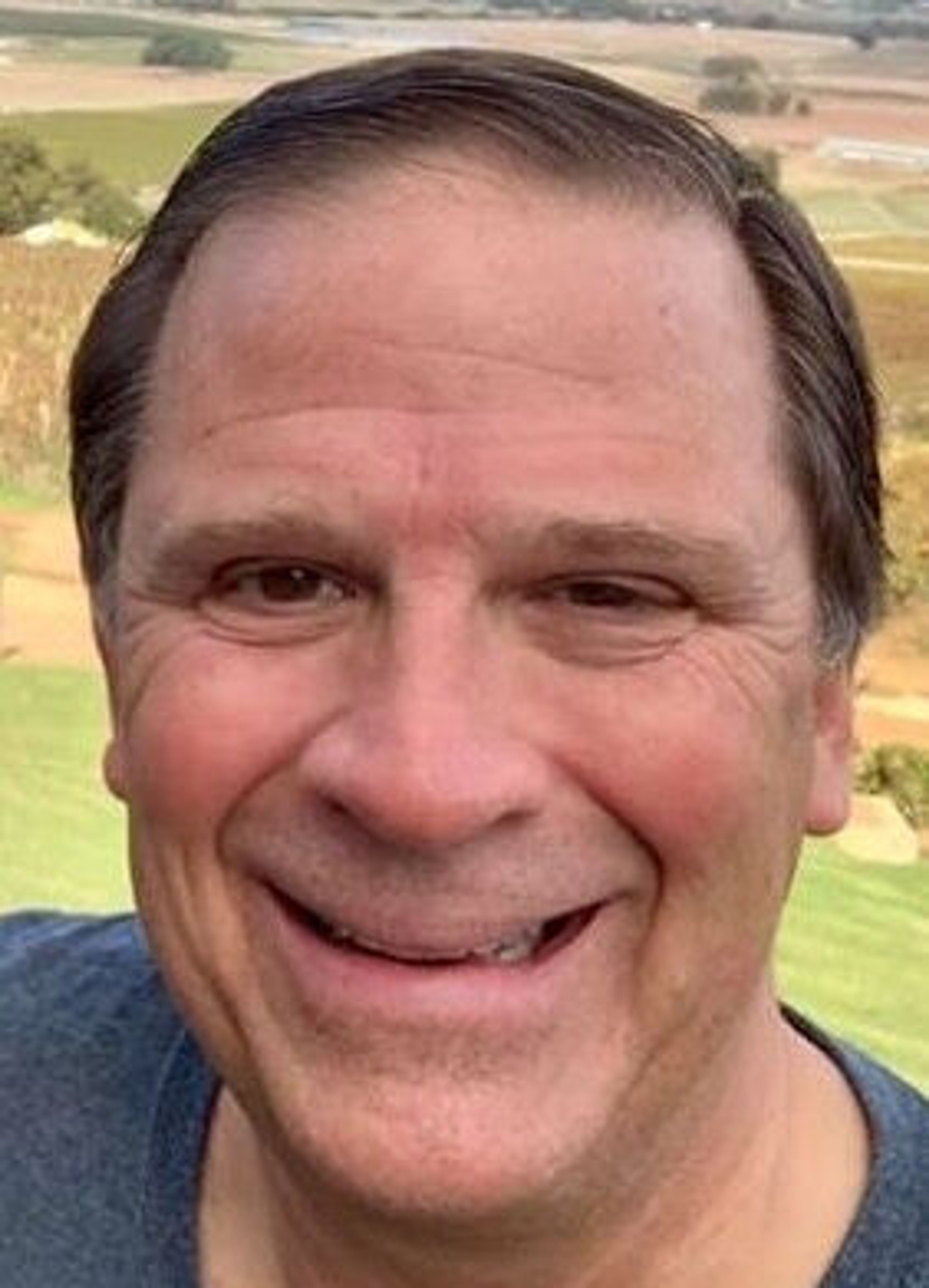

BOISE — Rep. Josh Tanner, R-Eagle, is proposing two different options that may remove tax exemptions for nonprofit hospitals in an effort to reduce property tax levy rates.

Other properties that can be exempt from property taxes include churches and nonprofit charitable organizations.

In one proposal, presented to the House Revenue and Tax Committee on Thursday, it would be left to each county board of equalization to determine if its local hospital should be put on the property tax rolls.

“This bill ... just pushes it to the county commissioners to make that decision on what’s best for their county,” Tanner told the committee.

Rep. Stephanie Jo Mickelsen, R-Idaho Falls, expressed concern that some rural hospitals in her district would likely close if they had to pay property taxes. Tanner responded by saying he anticipates it would affect mostly populated areas, because some rural hospital buildings are owned by another entity and the hospital agency just pays rent.

Tanner also faced questions from Rep. Kenny Wroten, R-Nampa, about whether it would create health care deserts in some areas and if hospitals might only be drawn to counties that are “more friendly.”

“Hospitals are a business,” Tanner said. “In the end, they’re going to do what’s best, business, financially, for them. … Really it’s going to allow the hospital itself to go lobby and negotiate with these county commissions on what is best for that community.”

His second option would allow main hospital facilities to remain exempt but all administrative and medical facilities outside that building would be subject to property taxes. Hospitals are defined in code as providing medical and nursing care, among other services, on a 24-hour basis.

Under this legislation, there would be no negotiation regarding whether or not the tax exemption can stay in place, Tanner said. Properties that would lose their exemption wouldn’t be included on new construction rolls.

The committee voted to introduce both bills, but Chairperson Jason Monks, R-Meridian, clarified the intention wouldn’t be to pass them both, but hearings will be held to discuss the options to determine what should move forward.

The committee voted to introduce both bills, but Chairman Jason Monks, R-Meridian, clarified that the intention wouldn’t be to pass them both, but hearings will be held to discuss the options to determine what should move forward.