In Kootenai County, only about a quarter of families can afford a home and fewer than half of renters can afford their rising monthly rent payments.

But the county, home to Coeur d’Alene, Post Falls and Hayden, isn’t the only in the state dealing with skyrocketing property values and rapid population growth, according to Steven Peterson, an associate clinical professor of economics at the University of Idaho and co-author of the “Kootenai County Affordability and Accessibility Housing Study.”

As more people began working from home during the pandemic, communities across Idaho saw an influx in residents from nearby states. Now, many locals are priced out.

“For Kootenai County, these price increases were widespread,” Peterson said. “It’s not just Coeur d’Alene. It’s the entire county, including the rural areas.”

In just the past four years, median housing costs in Kootenai County increased 120%, while average prices jumped nearly 150% within the same time frame.

During a presentation on Idaho’s housing crisis Friday evening, Peterson said a lack of new residential construction in the last decade has contributed to the problem. Skilled labor shortages and worldwide supply chain disruptions affecting lumber, steel and other materials also play a role.

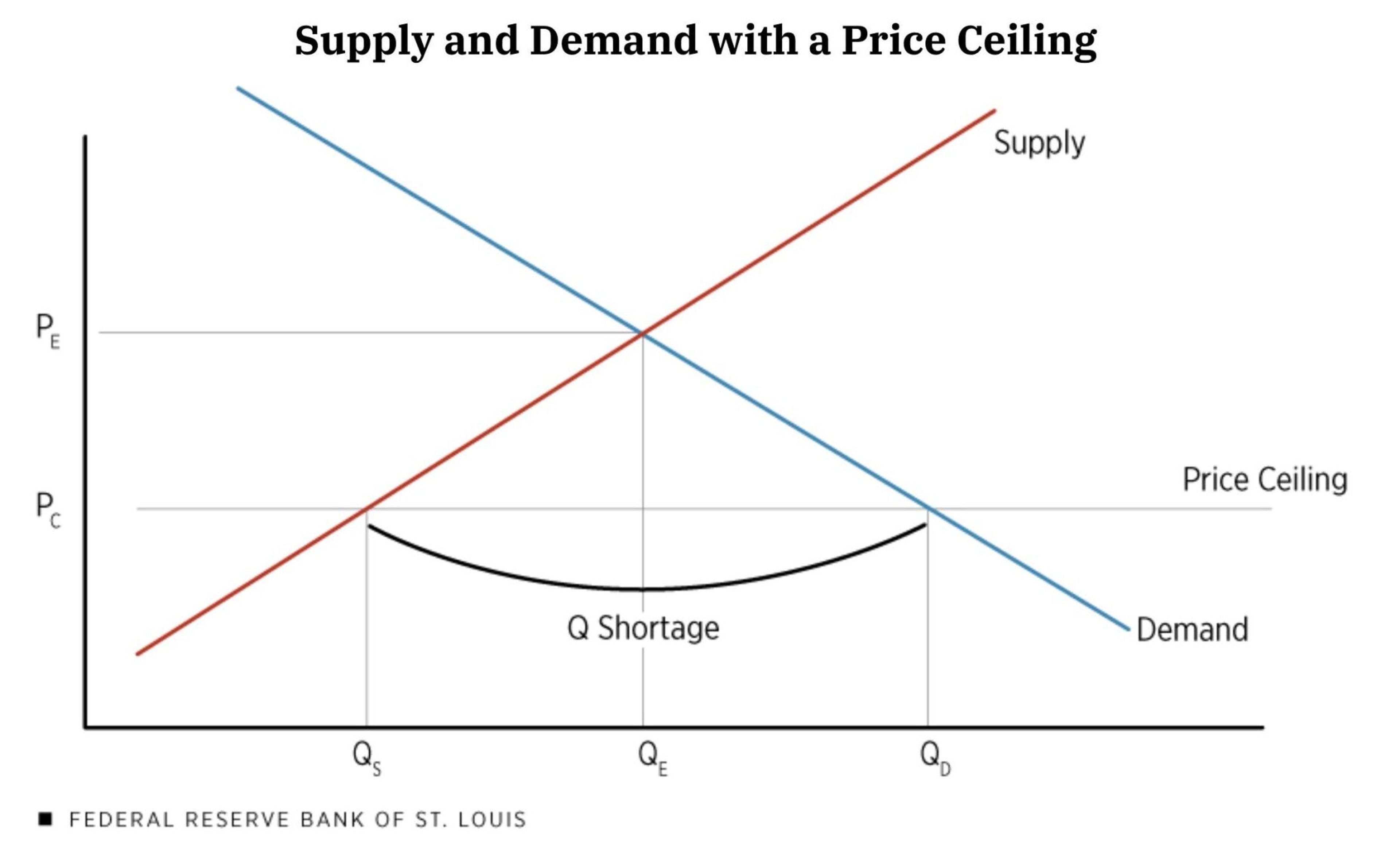

Increases in property demand, combined with a decrease in supply, has resulted in sharp price hikes for prospective homeowners.

“We know that if you allow housing prices to become extremely unaffordable, you will permanently alter the character of your community,” Peterson said. “And there are stakeholders that are of the belief they can do so.”

Home prices are also rising in many places across the country. During the past three years, from July 2018 to July 2021, home prices in the U.S. increased by nearly 30%, and rose 44% higher than the previous peak in 2006.

Coming off a 17% growth in population over the past decade, the second-fastest in the country, Idaho took the No. 1 slot for growth in housing prices.

In a ranking that ordered U.S. counties with the largest jumps in home costs for the past three years, the top four counties were in the Gem State. Canyon County experienced a near 95% increase in housing prices, followed by Ada County at 80%, Kootenai County at roughly 70% and Twin Falls County at 65%.

“Think about the price of a home at $750,000,” Peterson said. “What are the possibilities of your children being able to find a job that would allow them to afford to live in your community? There’s very little of that.”

Since 2010, home costs in almost every corner of Idaho have at least doubled. Peterson added that even in Lewiston, where he grew up, prices have increased by two-fold.

“These skyrocketing housing prices are in rural areas, they’re in urban areas and they’re in almost every county,” he said.

Just five years ago, about 75% of families in Kootenai County were able to afford a median-priced house. Now, in a complete reversal, nearly 75% of families are unable to afford a home in the current market.

A variety of factors, including short-term rentals like Airbnb, nonresident purchases of second homes, and recreation and tourism have contributed to the county’s housing crisis.

While the median home price in Kootenai County was $485,000 in 2021, the average price sat at $624,000 for the same year.

“How does the local hospital hire a nurse and have that nurse be able to find housing?” Peterson asked. “How does a school hire a teacher? Would a new startup firm or an entrepreneur want to locate there? Would they be able to pay enough wages for their employees to find housing?”

From August 2018 to August 2021, Idaho had the fastest-growing single-family housing costs in the country at an increase of 67%. The state also claimed the No. 3 spot for rent growth.

Most renters have seen prices increase by about 30% over the past six months.

To keep up with demand, Peterson said about 22,000 new units would need to be built over the next decade.

Although municipalities have little control over the migration of more affluent people to their communities, they can examine regulations like excessive building codes and zoning restrictions which can limit urban sprawl.

“We specifically addressed the issue in our study that most likely the case is Californians have more money than the locals,” he said. “And when you get into a bidding war for existing housing, it’s the locals that are going to lose. You don’t solve any problems by just trying to restrict housing and it leads to an increase in prices.”

The lack of affordability will affect local economies negatively, he added.

Based on a workforce analysis, the housing constraint is reducing employment and output around the state. Conservative estimates indicate there would be a direct job loss of just less than 1,600 unfilled positions total among existing firms in Kootenai County as a result of the area’s housing crisis. However, Peterson thinks it’s likely much higher.

Not to mention, the vast majority of multi-family housing sales have been sold to nonlocal investors.

“This rapid population growth we have continuously experienced doesn’t seem to be slowing down,” he said. “My guess is we have such an expanding market that it’d be unlikely to see a crash.”

Palermo can be reached at apalermo@dnews.com or on Twitter @apalermotweets.