Property tax freeze could evolve

Idaho Senate ponders amendments to bill, including making it a three-year freeze in tax rates rather than one year

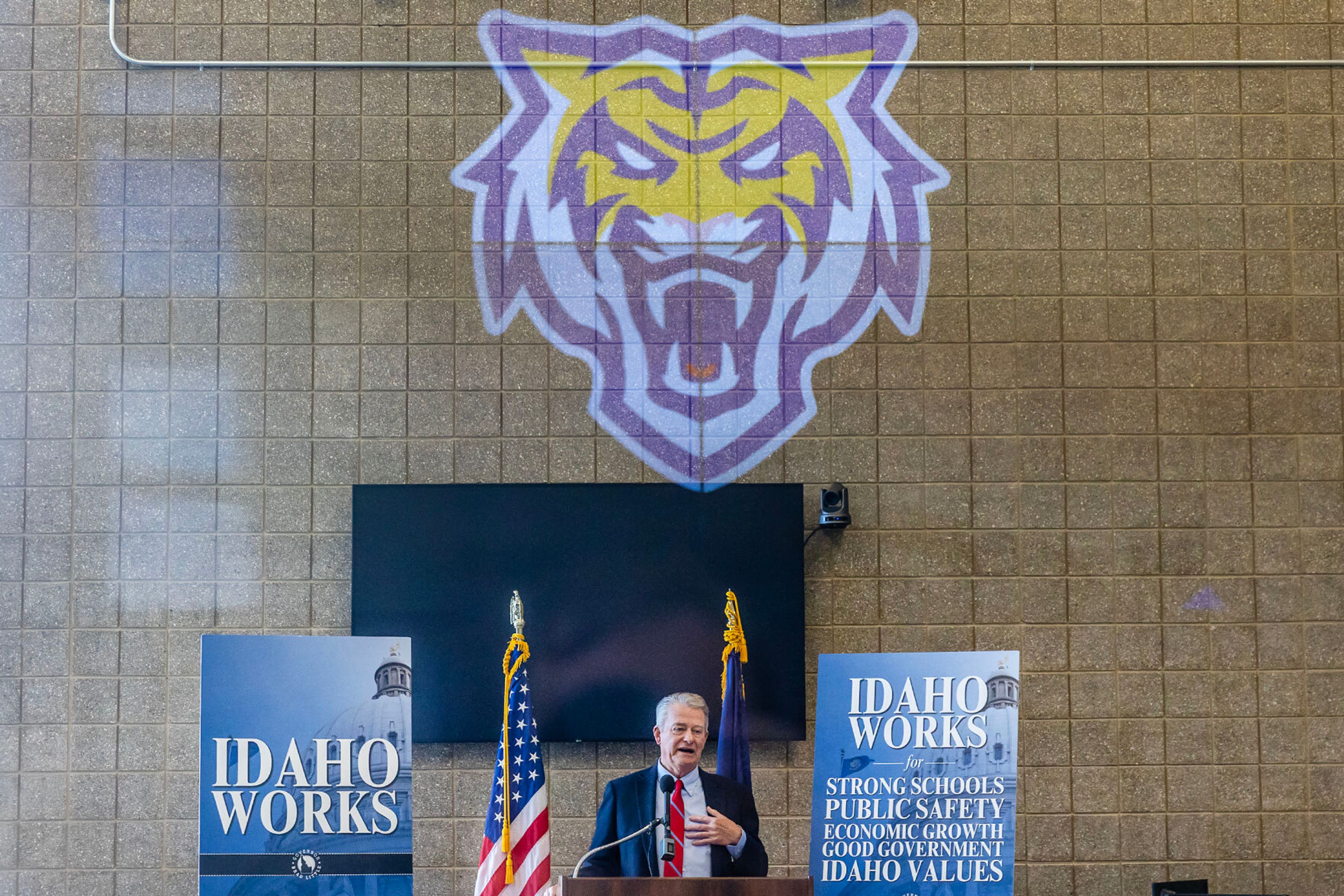

BOISE — An Idaho House proposal to freeze local government property tax revenues for the next year could turn into a three-year cap, once the Senate gets done amending it.

The legislation is sponsored by House Majority Leader Mike Moyle, R-Star, together with Rep. Jason Monks, R-Nampa, and Senate Local Government Chairman Jim Rice, R-Caldwell.

As originally written, the bill would prohibit all non-school local taxing jurisdictions from collecting more property tax revenue next year than they do this year. The measure wouldn’t freeze property tax bills for individual homeowners; however, Moyle believes it will motivate local government officials to “come to the table” and work with lawmakers to find a solution to the problem of rapidly rising property tax rates.

The intent, Moyle said, is to temporarily stall the rapid growth in local tax revenues, to give the Legislature and stakeholders time to craft a more permanent solution.

Despite strong opposition from city and county officials across the state, the bill passed the House last week on a 46-23 vote. Lewiston Reps. Mike Kingsley and Thyra Stevenson, Rep. Priscilla Giddings, R-White Bird, and Rep. Paul Shepherd, R-Riggins, supported the measure; Reps. Bill Goesling, R-Moscow, and Caroline Troy, R-Genesee, voted in opposition.

Rice’s committee held an hourlong hearing on the legislation Thursday afternoon.

From the start, he made it clear he’d like to amend the measure. Rather than a one-year freeze, he’s now proposing a three-year cap. Annual growth in property tax revenues would be limited to 4 percent; that includes new construction, annexations and any foregone taxes.

Current law, by contrast, allows 3 percent plus new construction, annexations and any foregone taxes the district wants to use.

In addition to a 4 percent cap, Rice would allow districts to collect new revenue from any urban renewal districts that sunset over the next three years, plus revenues from any expiring industry property tax credits the county had previously approved.

The proposed amendments didn’t mollify cities and counties to any great extent. The Idaho Association of Counties and Association of Idaho Cities both testified against the legislation Thursday, as did Ada County Commissioner Kendra Kenyon and several other local government officials.

“No two jurisdictions are alike,” noted Seth Grigg, executive director of the Association of Counties. “We don’t feel like that’s reflected in this bill.”

Several private citizens, by contrast, supported the original bill, saying a timeout was needed while the Legislature crafted a solution.

“Taxing districts have taken the position that it’s OK for me to lower my standard of living so they can maintain theirs,” said Hubert Osborne, a retired dairyman from Nampa. “Cash cows are nice — unless you’re the cow.”

Moyle also spoke in opposition to the proposed amendments, saying the bill worked well as originally written.

“I’ve watched and listened to the comments,” he said. “You hear people who are getting the (tax revenues) say they aren’t getting enough, while those who pay the taxes say they can’t afford to give any more. ... Amending this bill, I don’t think is wise. A freeze is the way to go.”

No one on the committee, though, favored that approach. Instead, they supported a motion to send it to the Senate “amending order.” That’s the place on the Senate calendar where legislation can be modified from its original form.

Once a bill is in the amending order, any number of amendments can be proposed. The full Senate votes on the amendments; the amended bill must then be approved before it can return to the House. Public hearings typically aren’t held on amended bills, no matter how significant the change.

If the House rejects the amendments, the bill either dies or it could be referred to a conference committee to try to work out an agreement with the Senate.

Whatever happens with the legislation, Sen. Kelly Anthon, R-Burley, cautioned the public that they probably won’t see any tax relief in the immediate future.

“This isn’t a tax relief bill,” he said. “At best, it’s a tax relief bill for possible taxes in the future. It’s an attempt to limit government growth, which may result in (lower) future taxes.”

William L. Spence may be contacted at bspence@lmtribune.com or (208) 791-9168.