Who’s worried about the U.S. national debt?

Analysis

On Oct. 20, three days after apologizing to the British people for “mistakes” that were made, Conservative Party Leader Liz Truss resigned as prime minister of the United Kingdom.

Her 45-day tenure was the shortest in British history — a parliamentary legacy dating back more than 300 years, to 1721.

What prompted such an ignominious exit was Truss’ proposal for the largest tax cuts in 50 years, without a plan to pay for them.

The tax and regulatory reforms she recommended were intended to spur economic growth. They had an estimated cost of about 260 billion pounds over five years — the equivalent of $60 billion per year. Most of that, however, would have been funded by debt, which sparked concerns about inflation and fiscal instability. British financial markets panicked, the public lost faith and Truss lost her party’s support.

Across the Atlantic, members of Congress must have been shaking their heads.

In America, Republican presidential candidates make trillion-dollar tax cuts the centerpiece of their campaigns. Democrats promise similar amounts for infrastructure spending or loan forgiveness programs.

A $60 billion deficit? Pffft. ’Tis but a pittance. The United States racks up that much debt in a month — and has done so, on average, every month for the last 40 years.

During the second quarter of 2020 alone, with the country locked in a pandemic shutdown, Congress approved $2.79 trillion in deficit spending on near-unanimous votes. That worked out to slightly more than $30 billion per day.

By the end of 2020, the federal debt had ballooned by $4.23 trillion — the largest one-year increase in U.S. history — an amount that by itself was larger than the entire annual budget of any other nation on Earth, except for China.

Congressional indifference to balancing the budget has gone on for decades now, but the practice reached a whole new trajectory in 2020. The two largest deficits in U.S. history occurred in 2020 and ’21, and ’22 is shaping up to be the third-largest. Combined, that will add more than $8.6 trillion to the national debt, an increase of 38%.

That steep trajectory makes one wonder how long the government can continue to meet its financial obligations. Have we entered a danger zone?

High debt ratios are ‘unsustainable’

“I thought we were in dangerous territory when we were $18 trillion in debt (in 2015),” said Idaho Sen. Mike Crapo.

Crapo is the ranking Republican on the Senate Finance Committee and a former chairman of the Senate Banking Committee.

During his 30 years in Congress, he has seen the national debt climb from about $4 trillion, or 62% of the Gross Domestic Product, to $31.37 trillion and an estimated 125% of GDP. Crapo has also been involved in every major debt-reduction discussion in Congress over the past 12 years.

His take on the stability of federal finances?

“I actually don’t understand why the bond market hasn’t been more leery (about continued government borrowing),” Crapo said. “I’ve spoken with a lot of economic experts about this, about why we aren’t seeing a problem. They told me if the debt gets above 70% of GDP, it’s dangerous, it can’t be sustained. But something has allowed us to get above 100% without collapsing.”

The folks he spoke with suggested the Federal Reserve had a lot to do with that. From 2007 until just recently, it was the buyer of last resort for virtually any amount of U.S. Treasury securities, ensuring that the market for government debt continued to operate.

The underlying strength of the U.S. economy has helped as well, keeping the debt-to-GDP ratio within historical norms, at least until the last decade or so.

Low interest rates are another mitigating factor. Prior to this year they were at historic lows, which meant it didn’t cost as much to borrow money.

As a percentage of expenditures, historical tables included in the annual federal budget indicate net interest costs on the federal debt last year were at their lowest level since World War II — a mere 5.2%.

As a percentage of revenues, net interest is currently about 8%, which is less than half what it was in the 1980s and ’90s. By comparison, the average U.S. household spends 9.6% of its disposable income on interest costs, according to the St. Louis Federal Reserve.

Rumors of an economic doomsday, it seems, are somewhat premature.

Government budgets not the same as household budgets

That’s essentially what proponents of Modern Monetary Theory have been saying every chance they get.

Modern Monetary Theory, or MMT, is an economic theory that has gained traction — and detractors — in recent years, at least with some members of Congress.

Stephanie Kelton, a professor of economics and public policy at Stony Brook University in New York, is one of MMT’s leading spokespersons. A former chief economist for the Senate Budget Committee and former adviser to Democratic presidential candidate Bernie Sanders, she is also the author of the best-selling book, “The Deficit Myth.”

In a 2021 TED Talk, Kelton cited Congress’ response to the COVID-19 pandemic as an example of how governments can and should address societal challenges.

“Governments did some extraordinary things,” she said. “They sent money to people directly, to help buy food and pay rent. They provided free COVID testing and expanded health care … And they did all this without raising taxes or having prolonged battles over the usual question of how to pay for it.”

A key provision of MMT is that federal budgeting is fundamentally different from household budgets. The government can literally print money, so “how to pay for it” is never an issue. The only question is whether the proposed expenditure is really worth doing, whether it benefits all of society or only a privileged few, and whether the government has the physical resources — the manpower, equipment and raw material — to enact the policy without causing inflation in the overall economy.

“Inflation is the only real limit on spending,” Kelton said.

If inflation isn’t a concern, MMT suggests government expenditures have a positive effect on the private sector by soaking up excess capacity and reducing unemployment.

When Congress spends more money than it raises in taxes, Kelton said, that surplus stays in the overall economy. Rather than burden the economy, deficits spur investment and growth.

“Their red ink is our black ink,” she said.

No limit on spending

Another MMT advocate, Warren Mosler, notes in his book, “Seven Deadly Innocent Frauds of Economic Policy,” that commercial banks “conjure” money into existence the same way the government does.

Banks have to abide by certain reserve requirements and regulatory guidelines, he said, but they aren’t limited to lending out what they collect in deposits.

When banks approve a loan, they create money electronically and deposit it in the borrower’s account. The Federal Reserve does the same thing. The only difference is that private banks create about 10 times as much electronic money as the Fed.

So if conjuring money and lending it to businesses and individuals who can go broke doesn’t raise fears about a financial Armageddon, why would defaulting be a concern when lending to a government that prints its own currency?

“The federal government isn’t going to ‘run out of money,’ ” Mosler wrote. “It can always make any and all payments in its own currency, no matter how large the deficit or how few taxes it collects. … There is no numerical limit on how much money our government can spend.”

Like Kelton, Mosler is quick to point out that inflation does restrict the amount the government can spend responsibly.

How to finance that spending, though, is a separate question from whether it’s responsible.

“The proper size of government is a political question,” Mosler said. “How many teachers do we want in classrooms, how many soldiers in the Army? What resources do we want to move from the private sector to the public sector?”

But how to pay for that proper level of government, through taxation or deficit spending, has less to do with dollars than with how hot or cold the economy is at any given time.

“Taxes are like the thermostat on the wall,” Mosler said. “If unemployment is high, you’re taking too much money out of the economy through taxes. If you have inflation or unemployment is ‘too low,’ you need to raise taxes. But taxes aren’t there to balance the budget or bring in money.”

Reliance on deficit spending a recent phenomenon

Setting inflationary concerns aside, MMT suggests federal policy decisions should be based on their tangible outcomes — who benefits and how — rather than on pointless debates about how to pay for them.

Naturally, some members of Congress find that perspective very refreshing and have gone so far as to suggest that the federal debt limit should be abolished altogether.

Others, however, see it as a fundamental threat to the nation.

Last year, for example, two resolutions were introduced in the House and Senate calling on Congress to reject Modern Monetary Theory, saying it was “a recipe for disaster.”

For many economists, though, MMT is pretty much a nonissue.

“I think it’s more of a politically driven theory that’s talked about a lot in social media. You don’t see much about it in academic papers,” said Jinhui Bai, an associate professor at Washington State University’s School of Economic Sciences.

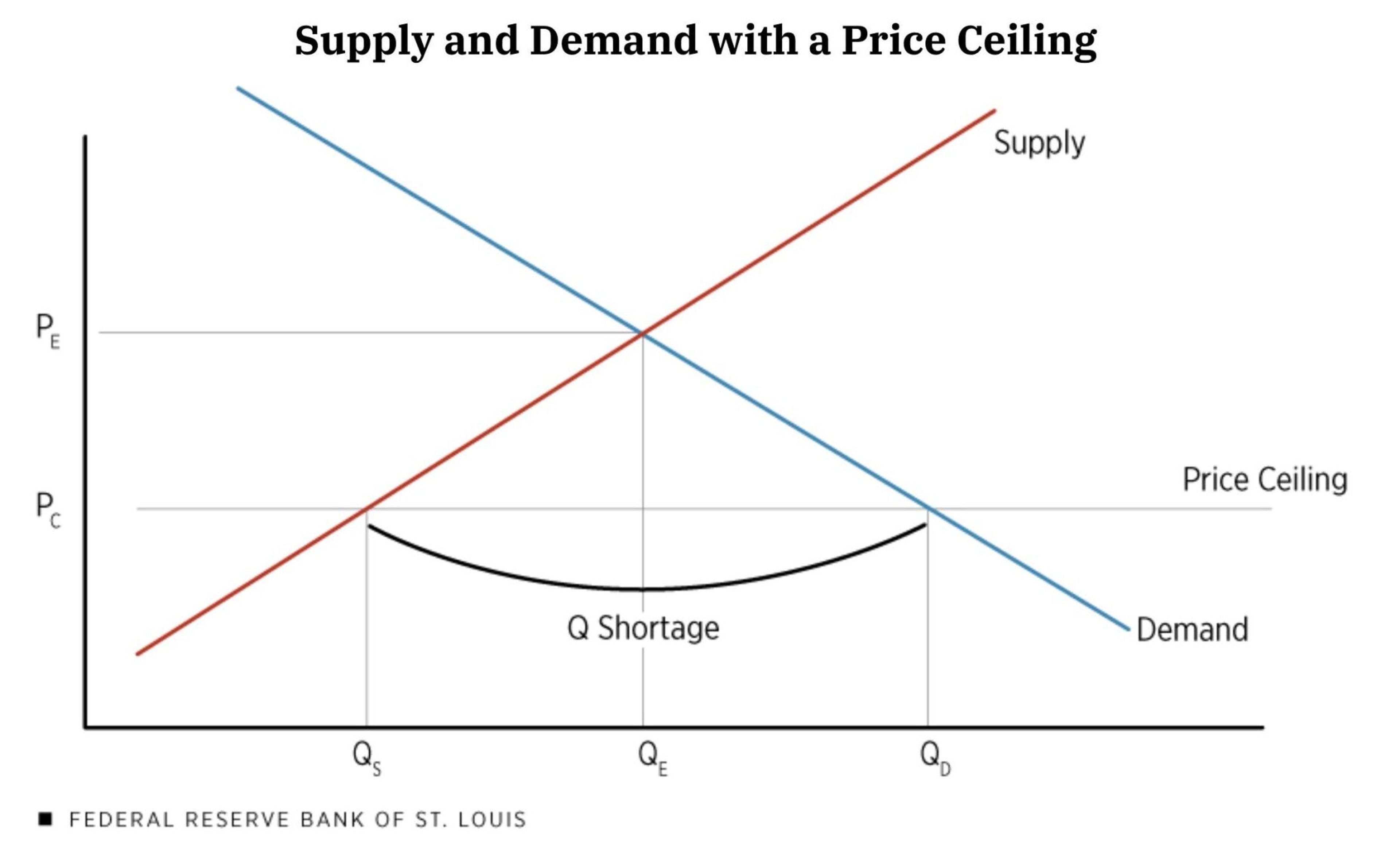

Mainstream economists don’t share MMT’s view that deficit spending is only a concern if it causes inflation, Bai said. Even if there’s no danger of an actual default, high debt-to-GDP ratios still act as a drag on the overall economy.

“It’s almost always true that you eventually have to increase taxes or cut spending,” he said.

Some studies suggest every 1% increase in the debt-to-GDP ratio leads to a 0.02% decline in future economic activity. In other words, doubling the debt-to-GDP ratio — as has happened in the United States just in the last 15 years — could translate into a 2% reduction in current GDP.

If so, that would amount to about $500 billion in foregone economic activity.

Bai noted that the federal government historically only incurred large amounts of debt during periods of war or extended national emergencies, such as the Great Depression.

Using debt to pay for normal government operations, tax cuts or to manage the overall economy “is quite a recent phenomenon,” he said. “It started sometime around the 1970s.”

However, deficit spending can provide some positive benefits during periods of significant economic disruption, Bai said, because it allows the government to avoid cutting spending or increasing taxes at the worst possible time.

“That’s a lesson that was learned from the Great Depression,” he said.

Moreover, as long as the economy grows at a faster clip than the national debt, it will keep the debt-to-GDP ratio in check, even if Congress never actually pays down the debt.

That’s what happened in the U.S. after World War II. The debt-to-GDP ratio dropped from a high of 118.9% to a low of 31.8% in 1981, even though the year-over-year debt level only decreased six times during that 35-year period.

“It’s really a privilege to grow your way out of debt,” Bai said. “That’s a math that the United States enjoys. It’s not true of most other countries.”

We’re all MMTers now

The last year-over-year decline in the national debt was in 1969.

Two years later, President Richard Nixon took the dollar off the gold standard, meaning foreign governments could no longer exchange U.S. currency for gold. From that point on, the dollar has been backed exclusively by the “full faith and credit” of the federal government.

After that decision, Nixon reportedly said he was “now a Keynesian” in economics.

The reference was to John Maynard Keynes, an English economist who challenged the prevailing free-market thinking and advocated for government intervention in the economy, particularly during recessionary periods.

Whether MMT proves to be an accurate economic theory or not, it clearly encourages an activist role for the federal government, just like Keynesian economics.

And it doesn’t necessarily restrict that role to times of recession. As Kelton said in her TED Talk, deficit spending could offer a solution to any national challenge, from climate change to the lack of affordable housing.

That concept may have some appeal for Bernie Sanders and the more progressive Democrats in Congress, but most lawmakers — and probably most Americans — still cling to the view that we need to pay for what we get.

Yet here we are, $31.37 trillion in debt. That didn’t happen exclusively on the Democrats’ watch. It didn’t happen exclusively on the Republicans’ watch.

It happened on our watch.

Every time we cheer an unfunded tax cut or demand congressional action to address one crisis or another, we add to the deficit. We move farther away from a balanced budget.

At what point do we, like the British people and British financial markets, say no?

“The notion that we can just print more money and keep paying the debt off leads to inflation,” Crapo said. “Why not just print $1 million for everyone? Because then a dollar becomes infinitely less valuable. The reason we can talk about a $30 trillion debt is because some extraordinary practices (by the Federal Reserve) have kept us from seeing a collapse. When the bond markets don’t trust us to pay them back with dollars that have the same value, that’s when it stops working.”

Spence may be contacted at bspence@lmtribune.com or (208) 791-9168.

A look at the national debt

This is the second of a two-part series regarding the federal debt. Part I in Saturday’s edition looked at the 2011 debt ceiling standoff in Congress, and the possibility for a repeat next year. That story can be read at bit.ly/3P2XVBo. Part II addresses whether the debt has reached dangerous territory.